33+ Income calculation in us mortgage

R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. During the 1990s marginal income tax rates rose and the US.

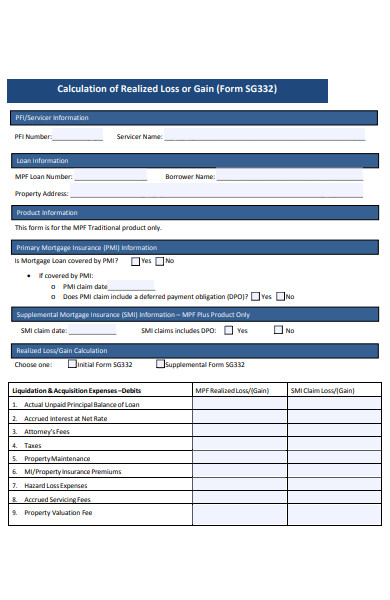

Free 31 Calculation Forms In Pdf Ms Word

1173 available at IRSgovirb.

. Total Monthly Home Debt Payments. Application of earned income tax credit in possessions of the United States. This means that you do not have to acknowledge us in.

Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment. When we write papers for you we transfer all the ownership to you. For high-cost areas the limit is 150 of the baseline which is 970800.

The alternative minimum taxable income AMTI is calculated by taking the taxpayers regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options. Created 216 million net new jobs. Shows what portion of your income is needed to cover all of your monthly debt obligations plus your mortgage payments and housing expenses.

33 49 5000 40 60 30 45 6000 36 54 27 41 7000 33 50 25 32 8000. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon. Other Monthly Debt Payments.

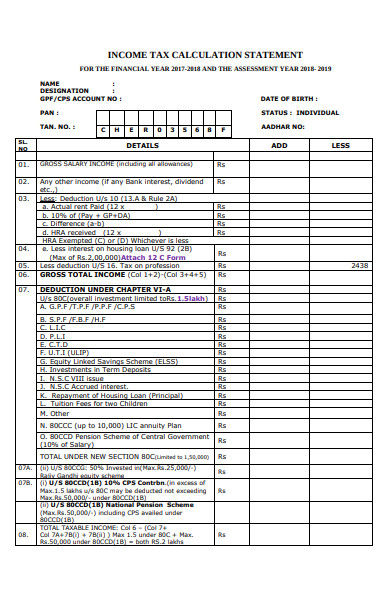

15 crores is to be calculated as per normal tax rate of 40 which amounts to Rs. 3933 million x 1 0145 45 million in year 3 Thats it. Taxable Income is Rs.

You can elect to use your 2019 earned income to figure your 2021 earned income credit if your 2019 earned income is more than your 2021 earned income. If your mortgage falls within this amount your loan qualifies as a conforming conventional mortgage. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

An individual does not have to be involved in the housing. During the 1980s marginal income tax rates were lowered and the US. This method is an alternative to the calculation allocation and substantiation of actual expenses.

Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Debt-ceiling crisis of 2011. US Tax Calculator and alter the settings to match your tax return in 2022.

Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income. Modification of disqualified investment income test. See Developer Notice on February 2022 changes to XML data feeds.

The 75 million created. Taxable Income is Rs. 2450 3800 if 65 or older and blind or Your earned income up to 12200 plus 1700 3050 if 65.

In specific years. The low income bias of the benefit calculation means that a lower paid worker receives a much higher percentage of his or her salary in benefit. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis.

Alternative minimum tax calculation. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values. Feel safe whenever you are placing an order with us.

Investment income limit increased. Financial crisis of 20072008. 26 Where the gain from the sale of a taxpayers personal residence results in business income as opposed to a capital gain the gain cannot be exempt from income tax as a result of the principal residence exemption under paragraph 402b.

In this case since the taxable income is more than 10 crore the company is liable to pay surcharge 5. The gov means its official. Whether to reference us in your work or not is a personal decision.

This 50k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Kansas State Tax tables for 2022The 50k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Kansas is used for. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. To calculate the percentage ROI for a cash purchase take.

Your earned income was more than 13900 15250 if 65 or older and blind. If it is an academic paper you have to ensure it is permitted by your institution. The tax payable will be 40 of Rs 95 lakh which is Rs 3800000.

You can send us comments through IRSgovFormComments. Your gross income was more than the larger of. Keep in mind that you can adjust this calculation to fit any time period that youd like to measure simply by changing the.

The par yields are derived from input market prices. The income tax on Rs. Federal government websites often end in gov or mil.

Created 183 million net new jobs. Determining your monthly mortgage payment based on your other debts is a bit more complicated. Created no net new jobs.

The resulting average rate is usually abbreviated to Libor ˈ l aɪ b ɔːr or LIBOR or more officially to ICE LIBOR for Intercontinental Exchange LIBOR. Each year high-income taxpayers must calculate and then pay the greater of an alternative minimum tax AMT or regular tax. Prior year 2019 earned income.

This lets us find the most appropriate writer for any type of assignment. This includes credit card bills car. Your gross income was at least 5 and your spouse files a separate return and itemizes deductions.

Credit allowed in case of certain separated spouses. Multiply your annual salary. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

The loan is secured on the borrowers property through a process. Your spouses income is also included in your income calculation provided you are applying for the loan together. Example Required Income Levels at Various Home Loan Amounts.

We do not ask clients to reference us in the papers we write for them. Temporary special rule for determining earned income for purposes of earned income tax credit. Before sharing sensitive information make sure youre on a federal government site.

From 2000 to 2010 marginal income tax rates were lowered due to the Bush tax cuts and the US. The amount of investment income you can receive and still be eligible to claim the EIC has increased to 10000. In 2022 the conforming loan limit for single-family homes is 647200 in US continental areas.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in LondonEach bank estimates what it would be charged were it to borrow from other banks. Daily Treasury PAR Yield Curve Rates This par yield curve which relates the par yield on a security to its time to maturity is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. NW IR-6526 Washington DC 20224. When the sale of a property results in business income.

Jackson Financial Inc 2021 Current Report 8 K

What Percentage Of Your Income For Mortgage Moneyunder30 Mortgage Payment Mortgage Payoff Mortgage

Usda Loan Pros And Cons Understanding Mortgages Usda Loan Mortgage

Free 31 Calculation Forms In Pdf Ms Word

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

Investor Presentation

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

Pin On Ux Ui Design

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

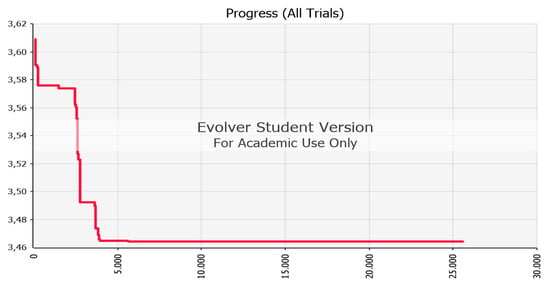

Jrfm Free Full Text Optimum Structure Of Corporate Groups Html

Jackson Financial Inc 2021 Current Report 8 K

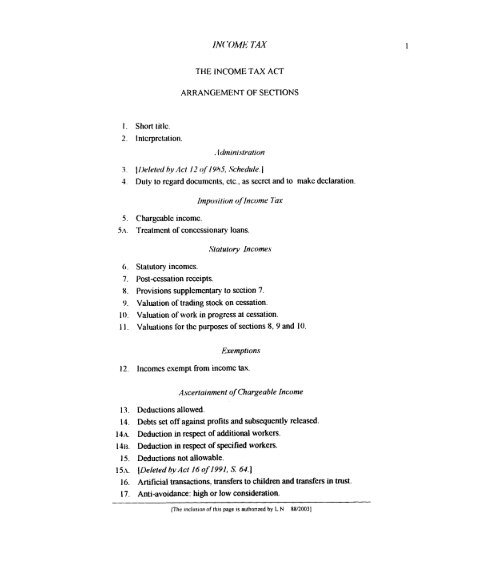

Income Tax Act Pdf Ministry Of Justice

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Salary 30 Year Mortgage Average

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com